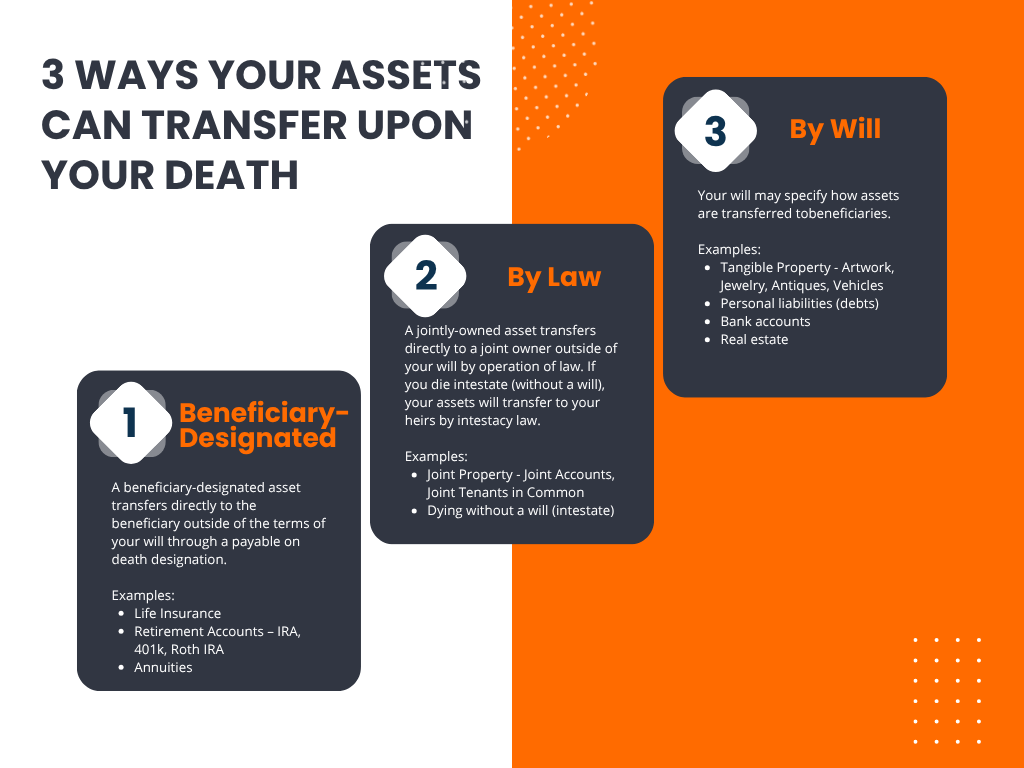

Three Ways Your Assets Transfer Upon Your Death

Having a robust estate plan ensures that your preferences are honored and your affairs are managed by someone you trust if you become incapacitated and/or if you die. When people think of an estate plan, they typically think of a will and/or a power of attorney. While a will can direct how some assets will pass at the time of your death, it might not control how other assets will pass at the time of your death.

There are three ways an asset can pass to others upon your death. First, some assets are governed by a beneficiary designation. Typical beneficiary-designated assets include: life insurance, retirement accounts such as IRAs and 401ks, and annuities. If a beneficiary is designated on this type of asset, then the asset will transfer directly to the beneficiary outside of the terms of your will. If a beneficiary is not designated on this type of asset, then the asset will pass according to the terms of your will, if you have one.

Second, some assets transfer by operation of law. Jointly-held property may transfer directly to a joint owner upon your death. For example, real property that is held as joint tenants with right of survivorship will transfer directly to the joint owner upon your death. Joint bank accounts will also transfer directly to the joint owner upon your death unless you specify otherwise. See 20 Pa. C.S. § 6304(a). Additionally, if you do not have a will, then your assets will transfer to your heirs as governed by intestacy laws. See 20 Pa. C.S. § 2101.

Third, some assets may be transferred upon your death by the terms of your will. Examples of things that will transfer by the terms of your will are: tangible personal property such as artwork, jewelry, furniture, antiques, and vehicles; debts; bank accounts that are not jointly-held; and real estate that is not jointly-held with right of survivorship.

In Pennsylvania, if an asset transfers directly to a beneficiary or a joint owner outside of the terms of your will, then that asset does not become part of the “probate estate” such that it will not be inventoried and be subject to probate fees. But in most cases, this directly-transferred asset will still be subject to Pennsylvania inheritance tax. For example, retirement accounts and most annuities ARE subject to Pennsylvania inheritance tax, while life insurance proceeds are NOT subject to Pennsylvania inheritance tax.

In short, be aware that some of your assets may not transfer upon your death under the terms of your will. You should review your beneficiary designations just as you would review your will. Significant life events, such as marriages, births, or deaths may necessitate a change to your will or your beneficiary-designations. Also keep in mind that if you have a joint bank account that you do not want to transfer directly to the other joint owner, then you need to express that to the bank when you are setting up the account. If you have questions about estate planning and live in Western Pennsylvania, Allegheny County, or White Oak, call me at 412-855-8269.